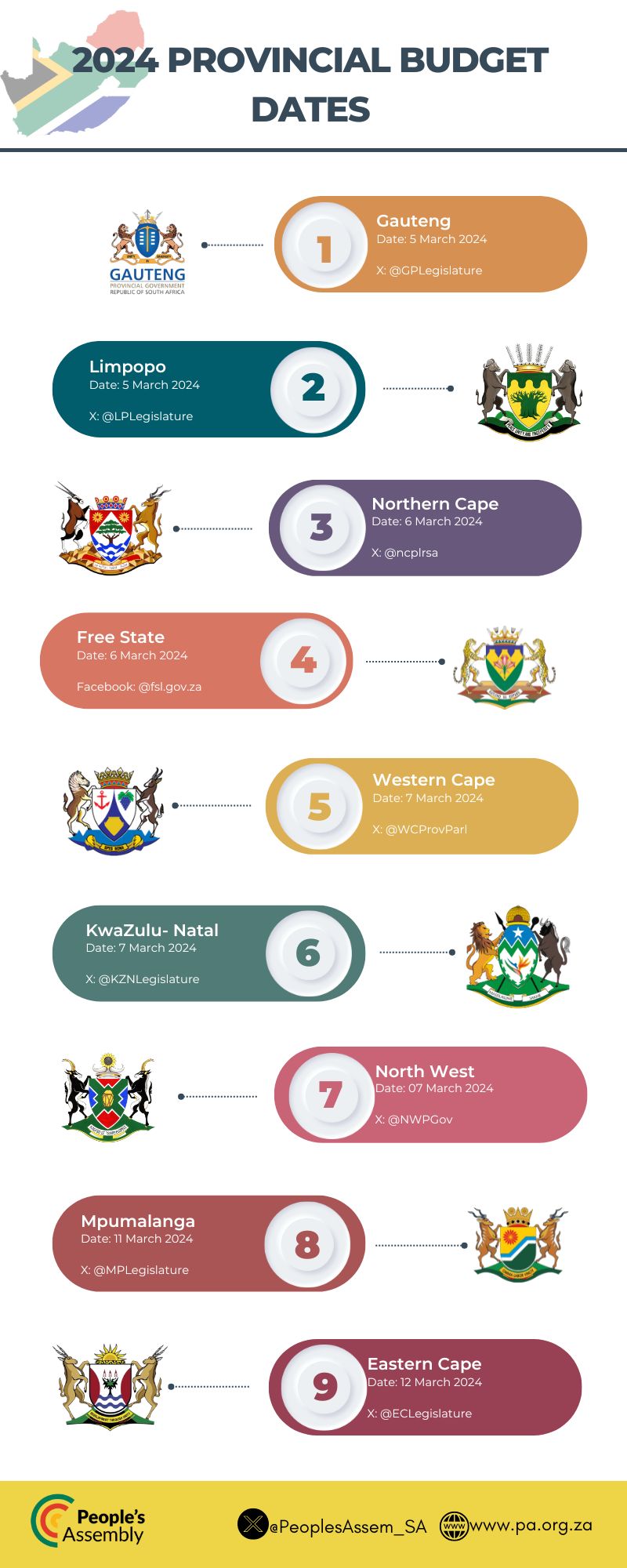

2024 Provincial Budget Dates

Gauteng (05 March 2024)

Gauteng Treasury Budget Summary

Limpopo (05 March 2024)

Northern Cape (6 March 2024)

Free State (06 March 2024)

Western Cape (7 March 2024)

KwaZulu-Natal (7 March 2024)

North West (7 March 2024)

Ms. Motlalepula Rosho l Watch

Mpumalanga (12 March 2024)

Ms. Nompumelelo Hlophe l Watch

Eastern Cape (12 March 2024)

The South African system of government is designed so that certain functions are exclusive (performed by one sphere only), while others are concurrent (shared between different spheres). The Constitution divides functions among the three spheres of government and clearly distinguishes between exclusive and concurrent responsibilities.

Concurrent functions include policy-making, legislation, implementation, monitoring, and performance assessment. Functions such as school education, health services, social welfare services, housing, and agriculture are shared between national and provincial governments. For these functions, the national government is largely responsible for providing leadership, formulating policy, determining the regulatory framework including setting minimum norms and standards, and monitoring the overall implementation by provincial governments. Provinces are responsible mainly for implementation in line with the nationally determined framework. Provincial departments therefore have large budgets for implementing government programmes, while the national departments have a relatively small share for their functions.

Transfers to provinces are made through respective equitable shares and conditional grants. The equitable shares are determined by formulas that take into account demographic and developmental factors. Conditional grants are designed to achieve specific objectives, and provinces and municipalities must meet certain criteria to receive grants and fulfill conditions when spending them.

Over the 2024 MTEF, the total provincial allocation is R2.3 trillion increasing from R2.2 trillion in the 2023 MTEF. This represents a nominal growth of 3.8 percent. The total provincial conditional grants allocation for the 2024/25 financial year amounts to R129 billion, increasing from R121.3 billion in the 2023/24 financial year representing a nominal increase of 6.3 percent.

Equitable shares are distributed through a formula that factors in demographic and developmental considerations. Conditional grants are intended to achieve specific objectives, and they are made available to provinces and municipalities upon meeting specific criteria and fulfilling conditions relating to their use.

Source: treasury.gov.za

Division of Revenue Bill - The bill provides for the equitable division of revenue raised nationally among the national, provincial and local spheres of government for the 2024/25 financial year; the determination of each province’s equitable share; allocations to provinces, local government and municipalities from national government’s equitable share; the responsibilities of all three spheres pursuant to such division and allocations; and for matters connected therewith.

To provide for the appropriation of money from the Provincial Revenue Fund for the requirements of the Province in the 2024/25 financial year; and to provide for matters incidental thereto, each province will pass an Appropriation Bill

About this blog

"That week in Parliament" is a series of blog posts in which the important Parliamentary events of the week are discussed.

We host the latest posts of this blog, written by People's Assembly. You can find more on PA's blog.

About this blog

"That week in Parliament" is a series of blog posts in which the important Parliamentary events of the week are discussed.

We host the latest posts of this blog, written by People's Assembly. You can find more on PA's blog.